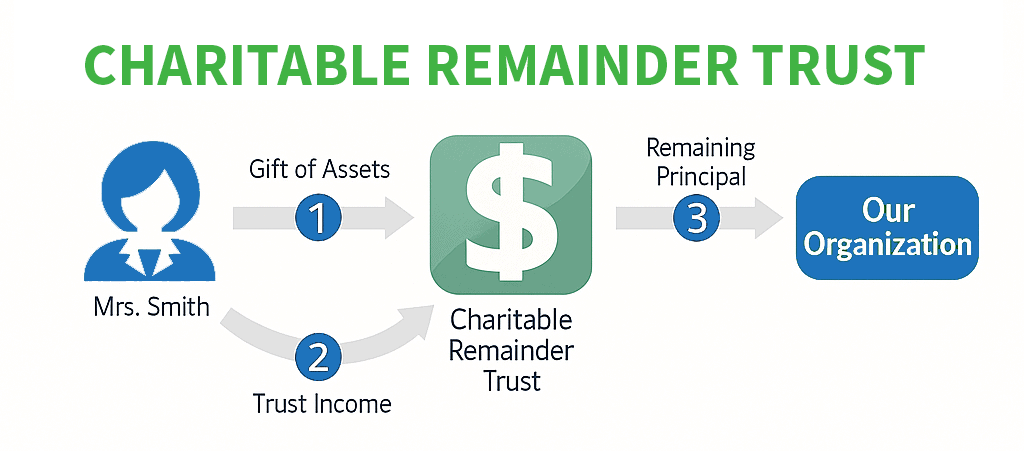

Charitable Remainder Unitrust (CRUT)

Support Wellness House while receiving income for life.

A Charitable Remainder Unitrust (CRUT) is a flexible gift plan that provides you or loved ones with variable income for life or a term of years. After the trust term ends, the remaining assets support Wellness House’s free cancer wellness programs.

Benefits:

-

Variable income based on annual trust value

-

Immediate charitable tax deduction

-

No capital gains tax on transfer of appreciated assets

-

Remainder supports Wellness House programs

Best For:

Donors with appreciated assets (stock, real estate) who want income and impact.

Follow Wellness House